Need Help Fixing Your Credit?

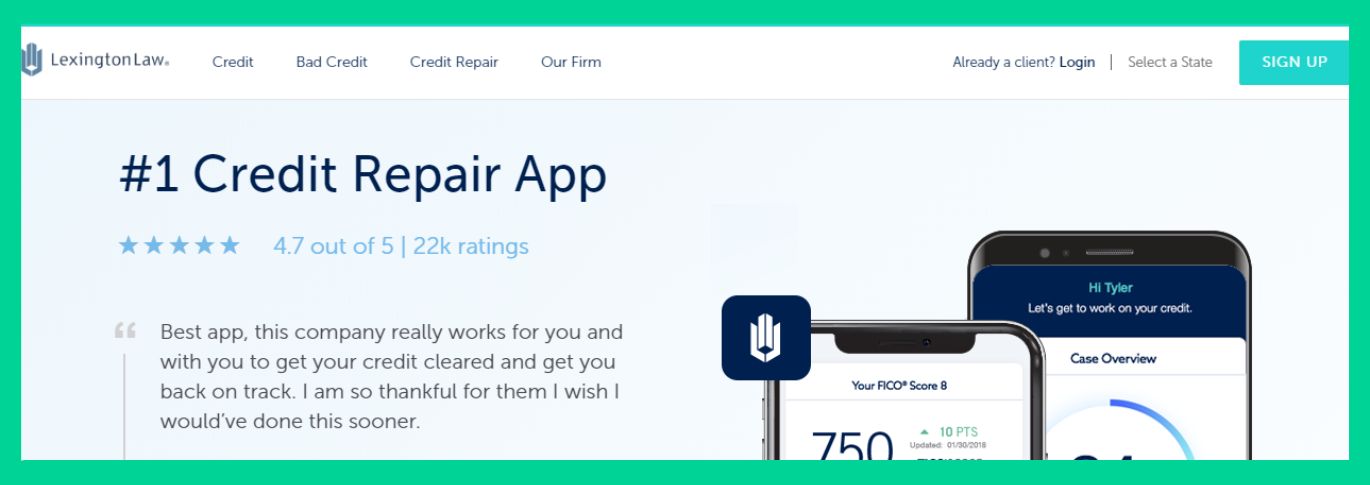

Lexington Law is one of the biggest credit repair attorney firms in the United-States, but unfortunately their services are currently not available for Canadians to use.

This is why, we decided to provide you with the best alternative to Lexington Law credit repair for Canadians!

What Is Lexington Law?

Lexington Law is an American law firm established in 2004 by John C. Heath. The firm specializes in providing credit repair services to Americans for a monthly fee of around $100. The firm abides by the Credit Repair Organizations Act (CROA) and is considered to be one of the best firms in America!

Read more: Do Free Credit Repair Companies Exist?

What Is The Best Canadian Alternative To Lexington Law’s Credit Repair Services?

If you’re a Canadian and are looking for credit repair services, you probably already stumbled upon Lexington Law’s services.

Unfortunately for you, you probably already realized that even though Lexington Law has some very good reviews and is being recommended by multiple bloggers and reviewers, their services aren’t available in Canada.

So, instead of wasting your time testing and reading reviews for other services that aren’t even available here in Canada, we actually recommend that you use our proven matching service by booking a FREE call with a trusted credit repair specialist near you! You just have to click on one of the buttons on this page to book your free call, trust us it’s worth it.

Need Help Fixing Your Credit?

8 Tips To Help You Fix Your Credit

- Increase your credit card limit: Even though this probably sounds a bit off to your ears, increasing your credit card limit actually reduces your credit utilization rate. Which is a huge factor in the credit score calculation.

- Pay your bills on time: As you can imagine, whenever you miss your bill payment, it sends a negative signal to credit bureaus (and therefore affects your credit score). If you struggle to pay your bills on time because you’re forgetting about them, we recommend having multiple reminders set on your phone or activating auto pay for your recurring bills.

- Create a budget (and follow it): Creating a budget and following it is another important step to increase your credit score. If you have a bad credit score, it’s probably because you have one or more bad financial habit. Having a budget will help you restrain the bad financial habits and stay on the healthy path.

- Consistency is key: Just like with anything else, consistency is key when it comes to repairing your credit. In fact, half applying any of the tips that we provide won’t help you raise your credit score. The best way is starting slow but staying consistent.

- Use less than 30% of your credit: Credit utilization rate is a very important factor in the credit score formula. Generally, it’s recommended to never have more than 30% of your total credit on your end of the month statement balance. What does that mean? Basically, if you have a total of 1000$ of available credit, you should never have a balance over 300$ at the end of the month.

- Consolidate your debt: If you have multiple different debts at a very high interest rate, we recommend that you consider consolidating your debt. Why? Not only you’ll get a better interest rate (and therefore lower payments), but you’ll actually be able to start paying off your debt instead of only paying the interest at the end of each month.

- Monitor your credit score: If you have a difficult time following what’s happening with your finances, we at least recommend you monitor your credit score on a weekly basis. You can do it for free by clicking here.

- Dispute any errors on your credit history: If you have errors on your credit history, make sure that they are corrected. This will heavily affect your credit score in a positive way. You can do it yourself by contacting your creditors and credit bureaus or use the help of a credit repair service.

À lire: How To Repair Credit Quickly? – Canadian Guide