See How Credit Repair In Waterville Works

Creditors Dispute

We ask your creditors to verify the negative items they’re reporting. If they can’t, they are required by law to stop reporting them.

Analysis

We analyze your questionable negative items hurting your score

Bureaus Check

We challenge with all three bureaus, ensuring your credit reports are accurate and fair.

Monitoring

We continue to watch your credit, addressing additional issues if they arise

10 Points Could Be The Difference Between Approved Or Denied

| NEGATIVE ITEM | SCORE DECREASE |

|---|---|

| Late payment | up to 110 points |

| Debt settlement | up to 125 points |

| Foreclosure | up to 160 points |

| Bankruptcy | up to 240 points |

| Collection | up to 110 points |

| Hard inquiry | up to 15 points |

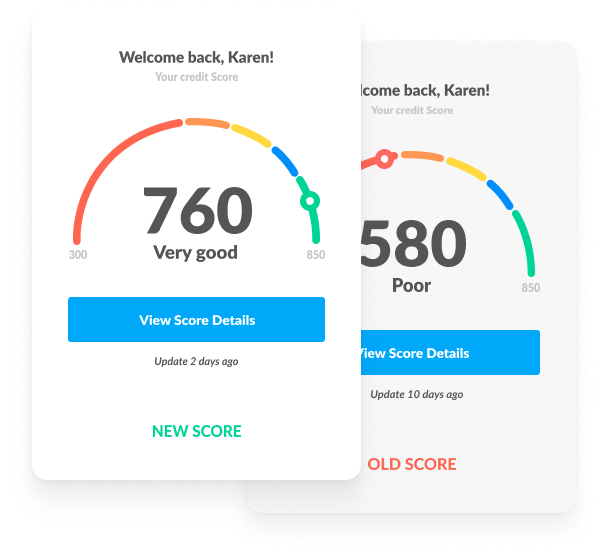

Did You Know? Any Score Lower Than 650 Is Considered “bad”.

A Bad Score Could Keep You From:

Getting approved

for a mortgage

Securing good

rates on a car loan

Getting a low-interest

credit card

Borrowing money

from a prime lender

What Is Credit Repair?

The process of credit repair involves hiring a company to remove inaccurate, negative information from your credit report.

What Do Credit Repair Companies Do?

To dispute these errors, a credit repair company communicates with the credit bureaus (Experian, Equifax and TransUnion) and/or financial institutions, such as your bank or debt collector.

The end goal is to have negative information removed from your credit file in order to improve your credit rating.

How Much Does Credit Repair Cost?

The cost of repairing credit depends on the option you choose; reviewing your own credit file is free. Credit repair software can cost between $25 and $500, and hiring a credit repair professional can cost between $30 and $150 per month initially.

How Fast Can A Credit Score Be Repaired?

Depending on how many disputes you need to file, the process typically takes 1-6 months. Typically, credit repair takes about 3-6 months, but it can be less if you only need to correct a few errors.

How Can I Wipe My Credit Clean?

It is possible to improve your credit score regardless of whether errors are found in your credit report.

There are 7 “easy” steps to wipe your credit clean:

- Get a copy of your credit report.

- Make sure you read every line of your credit report.

- If you find any errors, challenge them.

- Remove past-due accounts from your credit report.

- Reduce your credit utilization ratio.

- Resolve outstanding collections.

- Rinse and repeat.

What Is Debt Consolidation?

When someone consolidates debts, they obtain a new loan to pay off several small loans, debts, or bills that they are currently paying off. All these debts are effectively rolled into one combined loan and a single monthly payment is made. As several debts are brought together and combined into one loan, they are referred to as “consolidated”. Hence the name debt consolidation loan.

Can Debt Consolidation Help Your Credit Score?

Paying off your credit card balances each month may not be the best option; instead, you may be better off bundling your obligations into one payment at a lower interest rate, saving you money and simplifying your life.

According to a new Transunion report, consolidating could even improve your credit score. Credit scores improved by more than 20 points for nearly 70% of consumers who consolidated debt.

How Debt Affects Waterville, Quebec

Based on a 2021 report by Equifax, the average consumer debt in Canada (excluding mortgages) is $20,739 (source). If we dive in a bit deeper for Waterville residents, the average consumer debt in Quebec is $18,126 .

Since these numbers do not include mortgages, these are mostly credit card, student loan, personal loan and line of credit debt.

If you are living in Waterville and are stuck with debt that you can’t get rid off or with a bad credit score, don’t hesitate to give us a call. It’s free and super easy.