See How Credit Repair Works

Creditors Dispute

We ask your creditors to verify the negative items they’re reporting. If they can’t, they are required by law to stop reporting them.

Analysis

We analyze your questionable negative items hurting your score

Bureaus Check

We challenge with all three bureaus, ensuring your credit reports are accurate and fair.

Monitoring

We continue to watch your credit, addressing additional issues if they arise

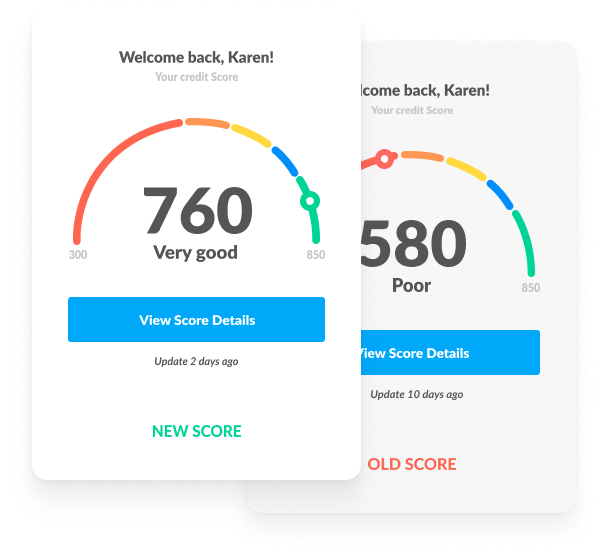

10 Points Could Be The Difference Between Approved Or Denied

| NEGATIVE ITEM | SCORE DECREASE |

|---|---|

| Late payment | up to 110 points |

| Debt settlement | up to 125 points |

| Foreclosure | up to 160 points |

| Bankruptcy | up to 240 points |

| Collection | up to 110 points |

| Hard inquiry | up to 15 points |

Did You Know? Any score lower than 650 is “bad”.

A bad score could keep you from:

Getting approved

for a mortgage

Securing good

rates on a car loan

Getting a low-interest

credit card

Borrowing money

from a prime lender

What Is Credit Repair?

The process of credit repair involves hiring a company to remove inaccurate, negative information from your credit report.

What Do Credit Repair Companies Do?

To dispute these errors, a credit repair company communicates with the credit bureaus (Experian, Equifax and TransUnion) and/or financial institutions, such as your bank or debt collector.

The end goal is to have negative information removed from your credit file in order to improve your credit rating.

How Much Does Credit Repair Cost?

The cost of repairing credit depends on the option you choose; reviewing your own credit file is free. Credit repair software can cost between $25 and $500, and hiring a credit repair professional can cost between $30 and $150 per month initially.

How Fast Can A Credit Score Be Repaired?

Depending on how many disputes you need to file, the process typically takes 1-6 months. Typically, credit repair takes about 3-6 months, but it can be less if you only need to correct a few errors.

How Can I Wipe My Credit Clean?

It is possible to improve your credit score regardless of whether errors are found in your credit report.

There are 7 “easy” steps to wipe your credit clean:

- Get a copy of your credit report.

- Make sure you read every line of your credit report.

- If you find any errors, challenge them.

- Remove past-due accounts from your credit report.

- Reduce your credit utilization ratio.

- Resolve outstanding collections.

- Rinse and repeat.

What Is Debt Consolidation?

When someone consolidates debts, they obtain a new loan to pay off several small loans, debts, or bills that they are currently paying off. All these debts are effectively rolled into one combined loan and a single monthly payment is made. As several debts are brought together and combined into one loan, they are referred to as “consolidated”. Hence the name debt consolidation loan.

Can Debt Consolidation Help Your Credit Score?

Paying off your credit card balances each month may not be the best option; instead, you may be better off bundling your obligations into one payment at a lower interest rate, saving you money and simplifying your life.

According to a new Transunion report, consolidating could even improve your credit score. Credit scores improved by more than 20 points for nearly 70% of consumers who consolidated debt.

Our Articles

The State of Personal Loans in Quebec | Guide

How to Check Your Business Credit Score

6 Tips To (Almost) Instantly Repair Your Credit

Top Credit Repair Companies In Canada

Lexington Law Credit Repair Alternative – Canada Edition

Do Free Credit Repair Companies Exist?

Our Locations

Find the closest location to you.

British Columbia

- Abbotsford

- Armstrong

- Burnaby

- Campbell River

- Castlegar

- Chilliwack

- Colwood

- Coquitlam

- Courtenay

- Cranbrook

- Dawson Creek

- Delta

- Duncan

- Enderby

- Fernie

- Fort St. John

- Grand Forks

- Greenwood

- Kamloops

- Kelowna

- Kimberley

- Langford

- Langley

- Maple Ridge

- Merritt

- Mission

- Nanaimo

- Nelson

- New Westminster

- North Vancouver

- Parksville

- Penticton

- Pitt Meadows

- Port Alberni

- Port Coquitlam

- Port Moody

- Powell River

- Prince George

- Prince Rupert

- Quesnel

- Revelstoke

- Richmond

- Rossland

- Salmon Arm

- Surrey

- Terrace

- Trail

- Vancouver

- Vernon

- Victoria

- West Kelowna

- White Rock

- Williams Lake

Newfoundland and Labrador

- Corner Brook

- Mount Pearl

- John’s

- Admirals Beach

- Anchor Point

- Appleton

- Aquaforte

- Arnold’s Cove

- Avondale

- Badger

- Baie Verte

- Baine Harbour

- Bauline

- Bay Bulls

- Bay de Verde

- Bay L’Argent

- Bay Roberts

- Baytona

- Beachside

- Bellburns

- Belleoram

- Birchy Bay

- Bird Cove

- Bishop’s Cove

- Bishop’s Falls

- Bonavista

- Botwood

- Branch

- Brent’s Cove

- Brighton

- Brigus

- Bryant’s Cove

- Buchans

- Burgeo

- Burin

- Burlington

- Burnt Islands

- Campbellton

- Cape Broyle

- Cape St. George

- Carbonear

- Carmanville

- Cartwright, Labrador

- Centreville-Wareham-Trinity

- Chance Cove

- Change Islands

- Channel-Port aux Basques

- Chapel Arm

- Charlottetown

- Clarenville

- Clarke’s Beach

- Coachman’s Cove

- Colinet

- Colliers

- Come By Chance

- Comfort Cove-Newstead

- Conception Bay South

- Conception Harbour

- Conche

- Cook’s Harbour

- Cormack

- Cottlesville

- Cow Head

- Cox’s Cove

- Crow Head

- Cupids

- Daniel’s Harbour

- Deer Lake

- Dover

- Duntara

- Eastport

- Elliston

- Embree

- Englee

- English Harbour East

- Fermeuse

- Ferryland

- Flatrock

- Fleur de Lys

- Flower’s Cove

- Fogo Island

- Forteau

- Fortune

- Fox Cove-Mortier

- Fox Harbour

- Frenchman’s Cove

- Gallants

- Gambo

- Gander

- Garnish

- Gaskiers-Point La Haye

- Gaultois

- Gillams

- Glenburnie-Birchy Head-Shoal Brook

- Glenwood

- Glovertown

- Goose Cove East

- Grand Bank

- Grand Falls-Windsor

- Grand le Pierre

- Greenspond

- Hampden

- Hant’s Harbour

- Happy Adventure

- Happy Valley-Goose Bay

- Harbour Breton

- Harbour Grace

- Harbour Main-Chapel’s Cove-Lakeview

- Hare Bay

- Hawke’s Bay

- Heart’s Content

- Heart’s Delight-Islington

- Heart’s Desire

- Hermitage-Sandyville

- Holyrood

- Howley

- Hughes Brook

- Humber Arm South

- Indian Bay

- Irishtown-Summerside

- Isle aux Morts

- Jackson’s Arm

- Keels

- King’s Cove

- King’s Point

- Kippens

- Labrador City

- Lamaline

- L’Anse-au-Clair

- L’Anse-au-Loup

- Lark Harbour

- LaScie

- Lawn

- Leading Tickles

- Lewin’s Cove

- Lewisporte

- Little Bay

- Little Bay East

- Little Bay Islands

- Little Burnt Bay

- Logy Bay-Middle Cove-Outer Cove

- Long Harbour-Mount Arlington Heights

- Lord’s Cove

- Lourdes

- Lumsden

- Lushes Bight-Beaumont-Beaumont North

- Main Brook

- Mary’s Harbour

- Marystown

- Massey Drive

- McIvers

- Meadows

- Middle Arm

- Miles Cove

- Millertown

- Milltown-Head of Bay d’Espoir

- Ming’s Bight

- Morrisville

- Mount Carmel-Mitchells Brook-St. Catherines

- Mount Moriah

- Musgrave Harbour

- Musgravetown

- New Perlican

- New-Wes-Valley

- Nipper’s Harbour

- Norman’s Cove-Long Cove

- Norris Arm

- Norris Point

- North River

- North West River

- Northern Arm

- Old Perlican

- Pacquet

- Paradise

- Parkers Cove

- Parson’s Pond

- Pasadena

- Peterview

- Petty Harbour-Maddox Cove

- Pilley’s Island

- Pinware

- Placentia

- Point au Gaul

- Point Lance

- Point Leamington

- Point May

- Point of Bay

- Pool’s Cove

- Port Anson

- Port au Choix

- Port au Port East

- Port au Port West-Aguathuna-Felix Cove

- Port Blandford

- Port Hope Simpson

- Port Kirwan

- Port Rexton

- Port Saunders

- Portugal Cove South

- Portugal Cove–St. Philip’s

- Pouch Cove

- Raleigh

- Ramea

- Red Bay

- Red Harbour

- Reidville

- Rencontre East

- Renews-Cappahayden

- River of Ponds

- Riverhead

- Robert’s Arm

- Rocky Harbour

- Roddickton-Bide Arm

- Rose Blanche-Harbour le Cou

- Rushoon

- Sally’s Cove

- Salmon Cove

- Salvage

- Sandringham

- Sandy Cove

- Seal Cove (Fortune Bay)

- Seal Cove (White Bay)

- Small Point-Adam’s Cove-Blackhead-Broad Cove

- South Brook

- South River

- Southern Harbour

- Spaniard’s Bay

- Springdale

- Alban’s

- Anthony

- Bernard’s-Jacques Fontaine

- Brendan’s

- Bride’s

- George’s

- Jacques-Coomb’s Cove

- Joseph’s

- Lawrence

- Lewis

- Lunaire-Griquet

- Mary’s

- Pauls

- Shott’s

- Vincent’s-St. Stephen’s-Peter’s River

- Steady Brook

- Stephenville

- Stephenville Crossing

- Summerford

- Sunnyside

- Terra Nova

- Terrenceville

- Tilt Cove

- Torbay

- Traytown

- Trepassey

- Trinity

- Trinity Bay North

- Triton

- Trout River

- Twillingate

- Upper Island Cove

- Victoria

- Wabana

- Wabush

- West St. Modeste

- Westport

- Whitbourne

- Whiteway

- Winterland

- Winterton

- Witless Bay

- Woodstock

- Woody Point, Bonne Bay

- York Harbour

- Hopedale

- Makkovik

- Nain

- Postville

- Rigolet

Ontario

- Barrie

- Belleville

- Brampton

- Brant

- Brantford

- Brockville

- Burlington

- Cambridge

- Clarence-Rockland

- Cornwall

- Dryden

- Elliot Lake

- Greater Sudbury

- Guelph

- Haldimand County

- Hamilton

- Kawartha Lakes

- Kenora

- Kingston

- Kitchener

- London

- Markham

- Mississauga

- Niagara Falls

- Norfolk County

- North Bay

- Orillia

- Oshawa

- Ottawa

- Owen Sound

- Pembroke

- Peterborough

- Pickering

- Port Colborne

- Prince Edward County

- Quinte West

- Richmond Hill

- Sarnia

- Sault Ste. Marie

- Catharines

- Thomas

- Stratford

- Temiskaming Shores

- Thorold

- Thunder Bay

- Timmins

- Toronto

- Vaughan

- Waterloo

- Welland

- Windsor

- Woodstock

Prince Edward Island

- Charlottetown

- Summerside

- Alberton

- Borden-Carleton

- Cornwall

- Kensington

- North Rustico

- O’Leary

- Souris

- Stratford

- Three Rivers

- Tignish

- Abram-Village

- Alexandra

- Annandale-Little Pond-Howe Bay

- Bedeque and Area

- Belfast

- Brackley

- Breadalbane

- Central Kings

- Central Prince

- Clyde River

- Crapaud

- Darlington

- Eastern Kings

- Greenmount-Montrose

- Hampshire

- Hazelbrook

- Hunter River

- Kingston

- Kinkora

- Linkletter

- Lot 11 and Area

- Malpeque Bay

- Miltonvale Park

- Miminegash

- Miscouche

- Morell

- Mount Stewart

- Murray Harbour

- Murray River

- North Shore

- North Wiltshire

- Northport

- Sherbrooke

- Souris West

- Felix

- Louis

- Nicholas

- Peters Bay

- Tignish Shore

- Tyne Valley

- Union Road

- Victoria

- Warren Grove

- Wellington

- West River

- York

Quebec

- Acton Vale

- Alma

- Amos

- Amqui

- Baie-Comeau

- Baie-D’Urfé

- Baie-Saint-Paul

- Barkmere

- Beaconsfield

- Beauceville

- Beauharnois

- Beaupré

- Bécancour

- Bedford

- Belleterre

- Beloeil

- Berthierville

- Blainville

- Boisbriand

- Bois-des-Filion

- Bonaventure

- Boucherville

- Lac-Brome

- Bromont

- Brossard

- Brownsburg-Chatham

- Candiac

- Cap-Chat

- Cap-Santé

- Carignan

- Carleton-sur-Mer

- Causapscal

- Chambly

- Chandler

- Chapais

- Charlemagne

- Châteauguay

- Château-Richer

- Chibougamau

- Clermont

- Coaticook

- Contrecoeur

- Cookshire-Eaton

- Côte Saint-Luc

- Coteau-du-Lac

- Cowansville

- Danville

- Daveluyville

- Dégelis

- Delson

- Desbiens

- Deux-Montagnes

- Disraeli

- Dolbeau-Mistassini

- Dollard-des-Ormeaux

- Donnacona

- Dorval

- Drummondville

- Dunham

- Duparquet

- East Angus

- Estérel

- Farnham

- Fermont

- Forestville

- Fossambault-sur-le-Lac

- Gaspé

- Gatineau

- Gracefield

- Granby

- Grande-Rivière

- Hampstead

- Hudson

- Huntingdon

- Joliette

- Kingsey Falls

- Kirkland

- La Malbaie

- La Pocatière

- La Prairie

- La Sarre

- La Tuque

- Lac-Delage

- Lachute

- Lac-Mégantic

- Lac-Saint-Joseph

- Lac-Sergent

- L’Ancienne-Lorette

- L’Assomption

- Laval

- Lavaltrie

- Lebel-sur-Quévillon

- L’Épiphanie

- Léry

- Lévis

- L’Île-Cadieux

- L’Île-Dorval

- L’Île-Perrot

- Longueuil

- Lorraine

- Louiseville

- Macamic

- Magog

- Malartic

- Maniwaki

- Marieville

- Mascouche

- Matagami

- Matane

- Mercier

- Métabetchouan–Lac-à-la-Croix

- Métis-sur-Mer

- Mirabel

- Mont-Joli

- Mont-Laurier

- Montmagny

- Montreal

- Montreal West

- Montréal-Est

- Mont-Saint-Hilaire

- Mont-Tremblant

- Mount Royal

- Murdochville

- Neuville

- New Richmond

- Nicolet

- Normandin

- Notre-Dame-de-l’Île-Perrot

- Notre-Dame-des-Prairies

- Otterburn Park

- Paspébiac

- Percé

- Pincourt

- Plessisville

- Pohénégamook

- Pointe-Claire

- Pont-Rouge

- Port-Cartier

- Portneuf

- Prévost

- Princeville

- Québec

- Repentigny

- Richelieu

- Richmond

- Rigaud

- Rimouski

- Rivière-du-Loup

- Rivière-Rouge

- Roberval

- Rosemère

- Rouyn-Noranda

- Saguenay

- Saint-Amable

- Saint-Augustin-de-Desmaures

- Saint-Basile

- Saint-Basile-le-Grand

- Saint-Bruno-de-Montarville

- Saint-Césaire

- Saint-Charles-Borromée

- Saint-Colomban

- Saint-Constant

- Sainte-Adèle

- Sainte-Agathe-des-Monts

- Sainte-Anne-de-Beaupré

- Sainte-Anne-de-Bellevue

- Sainte-Anne-des-Monts

- Sainte-Anne-des-Plaines

- Sainte-Catherine

- Sainte-Catherine-de-la-Jacques-Cartier

- Sainte-Julie

- Sainte-Marguerite-du-Lac-Masson

- Sainte-Marie

- Sainte-Marthe-sur-le-Lac

- Sainte-Thérèse

- Saint-Eustache

- Saint-Félicien

- Saint-Gabriel

- Saint-Georges

- Saint-Hyacinthe

- Saint-Jean-sur-Richelieu

- Saint-Jérôme

- Saint-Joseph-de-Beauce

- Saint-Joseph-de-Sorel

- Saint-Lambert

- Saint-Lazare

- Saint-Lin–Laurentides

- Saint-Marc-des-Carrières

- Saint-Ours

- Saint-Pamphile

- Saint-Pascal

- Saint-Philippe

- Saint-Pie

- Saint-Raymond

- Saint-Rémi

- Saint-Sauveur

- Saint-Tite

- Salaberry-de-Valleyfield

- Schefferville

- Scotstown

- Senneterre

- Sept-Îles

- Shannon

- Shawinigan

- Sherbrooke

- Sorel-Tracy

- Stanstead

- Sutton

- Témiscaming

- Témiscouata-sur-le-Lac

- Terrebonne

- Thetford Mines

- Thurso

- Trois-Pistoles

- Trois-Rivières

- Valcourt

- Val-d’Or

- Val-des-Sources

- Varennes

- Vaudreuil-Dorion

- Victoriaville

- Ville-Marie

- Warwick

- Waterloo

- Waterville

- Westmount

- Windsor

Other services : Payday Loans | Small Business Loans